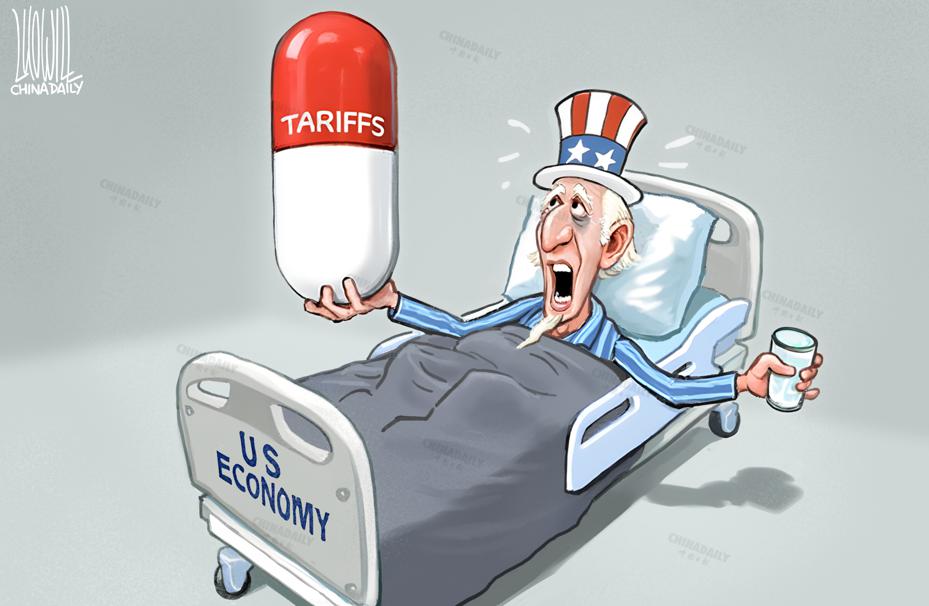

US tariffs to cause stagflation, global fracture

Editor's Note: On Wednesday, the Trump administration signed an executive order implementing "reciprocal tariffs" with a minimum baseline tariff of 10 percent and higher rates for certain trading partners, including China. Economists share their views with China Daily's Li Wei. Excerpts follow:

Impact likely to be stagflationary

The Trump administration's announcement of reciprocal tariffs is more severe than anticipated, signaling a sharp escalation in trade policy that could reshape the US economic landscape. If fully implemented, these measures would push the average tariff rate to 20-25 percent, a dramatic increase from the average effective tariff rate 2.4 percent seen in 2024. While exemptions for Canada, Mexico, and key industries—such as autos, steel, and energy—soften the blow somewhat, the broader implications remain concerning. The targeted tariff hikes, ranging from 10 percent to 49 percent, far exceed initial expectations and suggest a deliberate strategy to pressure trading partners into concessions.

The immediate economic impact is likely to be "stagflationary": higher prices coupled with slower growth. Inflation forecasts have been revised upward, with core personal consumption expenditures now expected to hit 4.7 percent by year-end, up from 3.5 percent. At the same time, GDP growth projections for Q4 have been slashed to 0.6 percent, down from 1.5 percent, while average NFP growth forecast lowered to 90,000 per month. The combination of rising costs and weaker demand raises the specter of recession, though the baseline scenario still assumes a continued expansion.

For the Federal Reserve, this presents a complex dilemma. While policymakers are expected to prioritize inflation control in the near term, the front-loaded nature of the tariff shock—along with mounting growth risks—could accelerate the timeline for monetary easing. Previously, no rate cuts were anticipated until mid-2026, but the new outlook suggests an initial cut in December 2025, followed by two more in early 2026. This shift reflects the growing likelihood that tariff-induced inflation will prove transitory.

Yet there is room for skepticism about whether these measures will be fully enforced. The Trump administration has a history of announcing sweeping tariffs only to walk them back after securing negotiated concessions. The current rollout, with staggered implementation dates and carve-outs for strategic allies, hints at a similar playbook—using the threat of protectionism as leverage rather than a fixed policy. The White House has already signaled openness to reducing rates in exchange for trade compromises or alignment on security priorities, reinforcing the view that these tariffs are as much a bargaining tool as an economic strategy.

David Seif is the chief economist for developed markets at Nomura; and Aichi Amemiya is the senior US economist at the same institute.