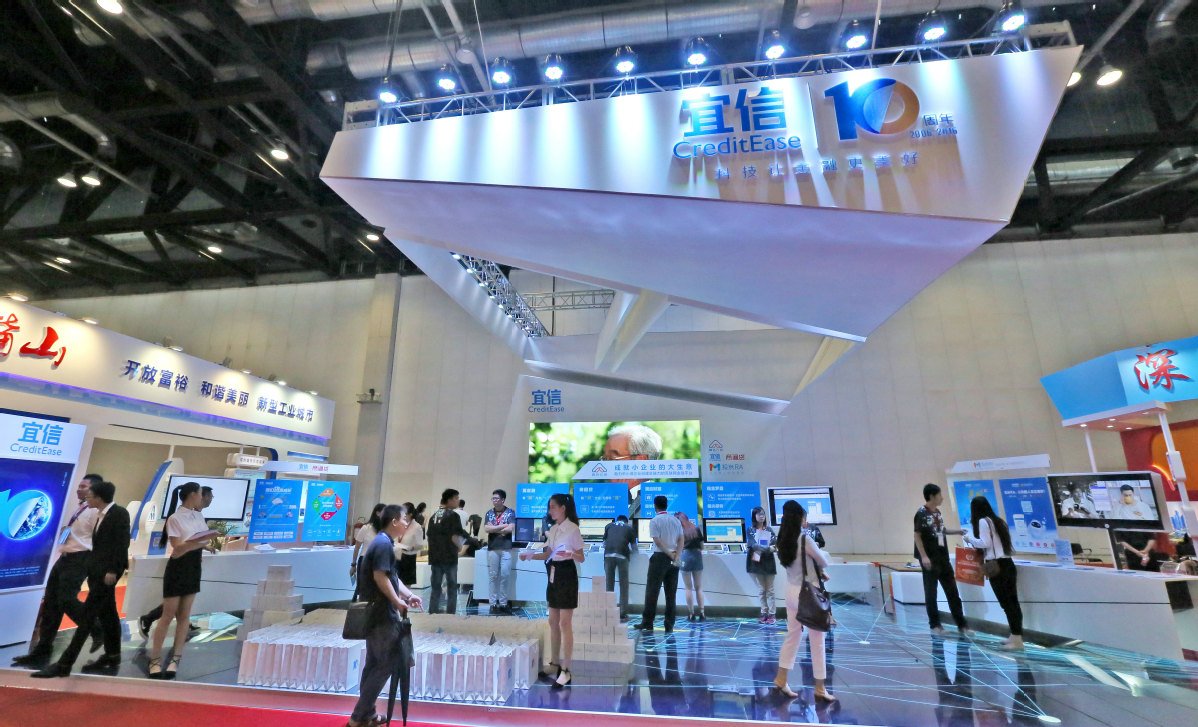

CreditEase backing inclusive finance with cutting-edge tools

Fintech company working with digital innovators to further improve options for SMEs

Fintech conglomerate CreditEase is exploring measures to help small businesses to gain access to financing and embrace digital transformations, by building partnerships with digital solution providers.

Wang Xia, the owner of a barbecue restaurant in Hangzhou, Zhejiang province, had a hard time hiring waiters due to rising labor costs, until Hangzhou Dfire Technology Co Ltd contacted her.

The company provides intelligent solutions that allow diners to send orders and payments online via their smartphones. The system also generates financial statements for restaurant and retail business owners, based on real-time recording and analysis of operational data.

"Previously, we recorded earnings and cash flow by ourselves. It was a lot of work, and the financial records were sometimes inaccurate," Wang said. "Using the hardware and software provided by Dfire Technology, we were able to solve the problem and cut labor costs by 15 to 20 percent at all three branches of our restaurant."

Last year, she obtained a non-collateral loan of 200,000 yuan ($29,000) from CreditEase. As a partner of Dfire Technology, the Beijing-based fintech company granted the line of credit based on the transaction and operational data of her business.

Wang Fuxing, chief operating officer and chief financial officer of Dfire Technology, said the company offers marketing, financial and management services to enable merchants to expand their digital capabilities, increase efficiency, and reduce costs based on analysis of their operational data.

Dfire Technology has partnered with dozens of financial institutions that provide financial services to such merchants.

Highlighting the value of the company's business model, CreditEase said it is cooperating with the technology firm to help small and microenterprises to gain access to funding more easily by undergoing digital transformation.

"Unlike traditional drivers of economic growth, such as manufacturing and real estate, the digital economy is based on intangible assets, including innovation, technology and branding. As a result, it requires new financial services models other than traditional banking," said Tang Ning, founder and CEO of CreditEase.

"By adopting big data technologies to analyze small businesses' operating conditions and manage any related risk, financial institutions and fintech firms will find a way to help small and microenterprises to solve their financing difficulties," he said.

Small businesses often lack collateral, guarantees and financial statements, creating roadblocks to securing financing. To resolve this problem, financial institutions must ramp up efforts to collect and utilize comprehensive data relating to small businesses through fintech innovations, said Liu Kegu, academic advising team leader for the inclusive finance commission at the China Association for the Promotion of Development Financing.

He noted there are four dimensions of data on small and microenterprises: data acquired by financial institutions via offline channels; online big data; data provided by government institutions in areas such areas as taxation, industry and commerce, social security, poverty alleviation and subsidies; as well as data collected from communities in rural and urban areas.

"The vigorous growth of small and microenterprises needs a large number of financial institutions at the grassroots level, various innovative financial products, and flexible multilayer financial regulation that varies for different small companies. These are the three pillars supporting inclusive finance," Liu said.